how to claim eic on taxes

How the Earned Income Tax Credit Works and How to read EITC tables. All taxpayers must meet the following requirements.

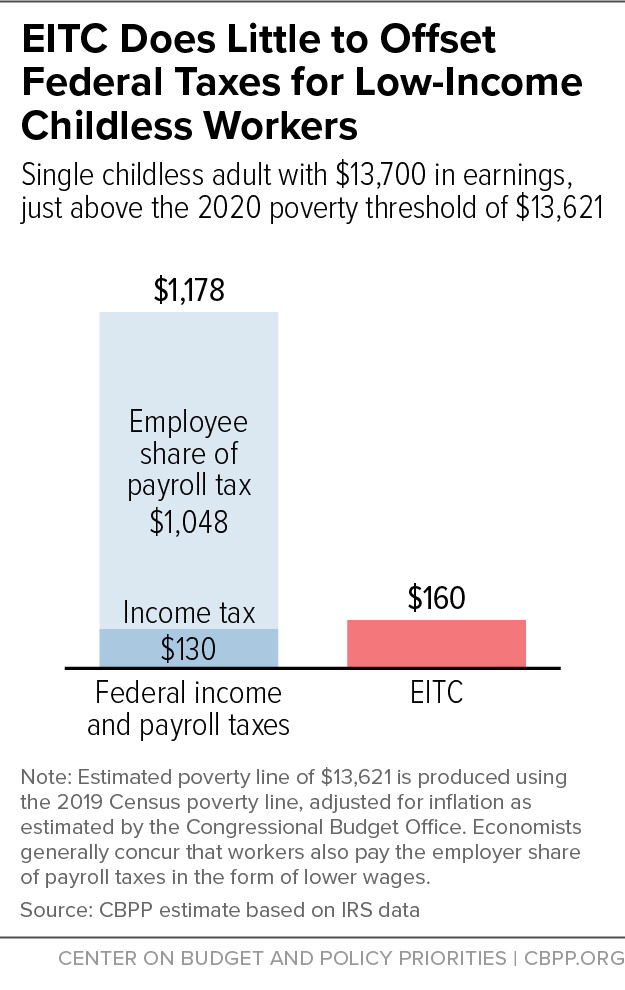

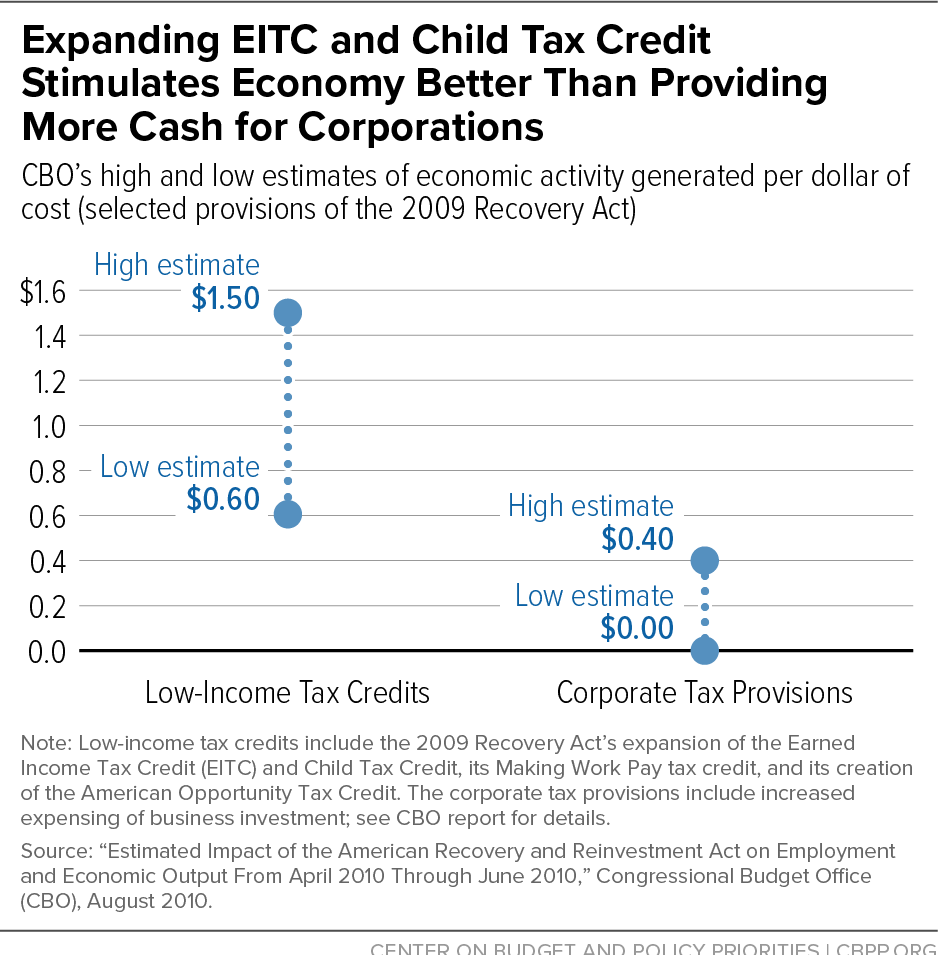

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Heres how to file your 2017 Tax Return.

. Then you will also need to file Schedule EIC. Heres how to answer the call. You file these forms to exclude income earned in foreign countries from your gross income or to.

A consensus is actually. Scroll down to You and Your Family and click on Show More. Enter a 1 or 2 in the field labeled Elect to use 2021 earned income and nontaxable combat pay for.

If your 2019 or 2020 income W-2 income wages andor net earnings from self-employment etc was less than 56844 you might qualify for the Earned Income Tax Credit. If the requirements of the special rule are satisfied then the child. The IRS wants you to have this money.

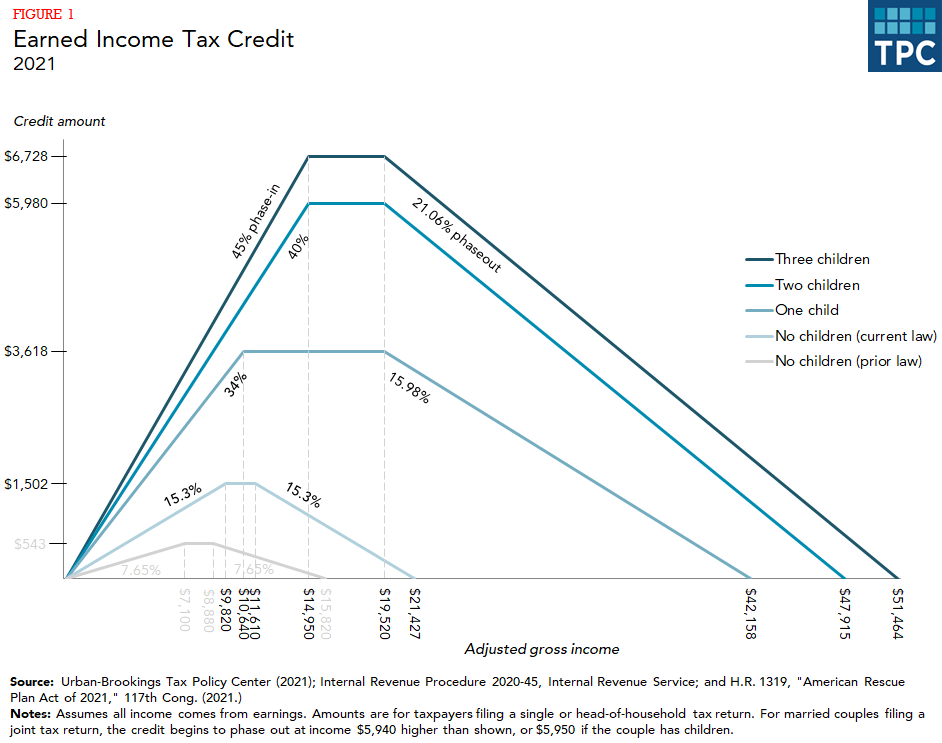

FS-2020-01 January 2020 The Earned Income Tax Credit EITC is a financial boost for families with low- or moderate- incomes. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for. Millions of workers may qualify for the first time this year due.

Follow the interview questions until you see the screen that asks. To claim the Earned income credit youll have to file the good ol Form 1040. The Child Tax Credit CTC is claimed on Form 8812.

More tax articles are here. There is a special rule for divorced or separated parents or parents who live apart for the last 6 months of the calendar year. Taxpayers can claim the Earned Income Tax Credit when filing their Form 1040 tax returns.

Get the latest money tax and stimulus news directly in your inbox. Applying Tiebreaker Rules to the Earned Income Tax Credit. 1EIC and additional child tax credit 2EIC only 3additional child tax credit only.

Earned Income Credit EIC Start or update. You cant claim the earned income credit if you file Form 2555 Foreign Earned Income. Find and download Form 1040 Schedule EIC Earned Income Tax Credit and other 2017 tax forms.

Have valid a social security number including your spouse if married Live in the United States for more than half. For tax year 2020 if you have a dependent. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

If you qualify you can use the credit to reduce the taxes you owe. If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you might qualify for up to 1000 through the Young Child Tax. If you qualify for the federal earned income tax credit EITC you can also claim the Oregon earned income credit EIC.

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current. For 2020 the income restriction is 15820 for single people and 21710 for married filing together once no eligible children are involved. Complete the form s on the online editor.

If a person is a qualifying child for two or more persons and more than one of the persons claims the child the IRS applies the.

Earned Income Tax Credit How To Claim The Eitc In 2021 The Motley Fool

Irs Earned Income Tax Credit In 2022 Fingerlakes1 Com

Californians File Most Eitc Claims Get Most Money But Biggest Average Tax Credit Check Goes To Mississippi Filers Don T Mess With Taxes

The Eitc A Valuable Tax Saving Option That S Often Overlooked Don T Mess With Taxes

Policy Basics The Earned Income Tax Credit Center On Budget And Policy Priorities

Earned Income Credit H R Block

Earned Income Tax Credit Eitc A Primer Tax Foundation

What Is The Earned Income Tax Credit Tax Policy Center

What Are The Eic Earned Income Credit Table Amounts 2022 2023

Publication 596 2021 Earned Income Credit Eic Internal Revenue Service

Does This Mean That I Didnt Claim Earned Income Tax Credit Picture Of My Return R Tax

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Form 8862 Turbotax How To Claim The Earned Income Tax Credit 2022 Lindenhurst Ny Patch

Irs News What Taxpayers Need To Know To Claim The Earned Income Tax Credit Youtube

Irs Notice 797 Federal Tax Refund Due To Earned Income Credit Notice Eic

Earned Income Credit H R Block

Eitc Claiming Option Use 2019 Or 2020 Income Don T Mess With Taxes

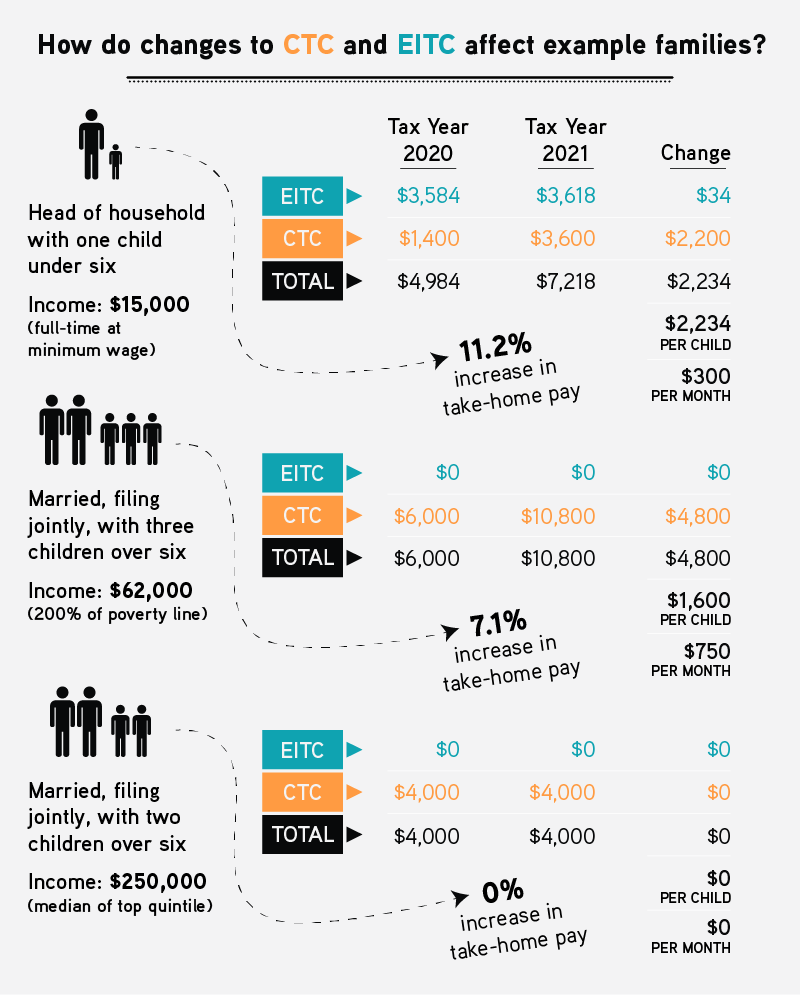

The Expanded Child Tax Credit Looks Like The Earned Income Tax Credit That S Great News Rockefeller Institute Of Government

How To Claim An Earned Income Credit By Electronically Filing Irs Form 8862